D.C. Circuit Review – Reviewed: Jurisdiction and Taxes

Benjamin Franklin famously observed that “in this world nothing can be said to be certain, except death and taxes.” Equally inevitable in federal litigation: jurisdictional tussles. Last week’s decisions feature a range of jurisdictional disputes: primary jurisdiction, statutory jurisdiction, standing, and sovereign immunity. We also encounter a perennial tax question.

In Fairless Energy v. FERC, the Court denied a petition for review of a FERC rate determination. Fairless Energy contracts with Transcontinental Gas Pipe Line Company to transport natural gas to fuel Fairless’s power plant. Fairless and Transco disagree about the rate Fairless is supposed to pay under their agreements. Fairless sued Transco for breach of contract in state court, and in response, Transco sought a declaration from FERC that Transco’s interpretation of the agreement was correct. Although the state court declined to dismiss or stay Fairless’s suit, FERC decided to exercise primary jurisdiction and sided with Transco on the rate. The decision by Judge Childs (joined by Judge Rogers*) seems potentially ground-breaking in that it endorses FERC’s position that “[w]hether to exercise primary jurisdiction is a matter solely within the Commission’s discretion.” On that basis, the panel subjects FERC’s decision to exercise primary jurisdiction to deferential arbitrary and capricious review.

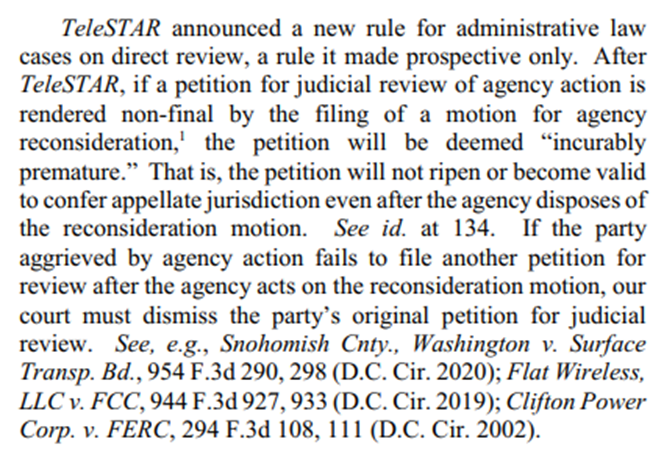

The Court dismissed the petition for review in National Association of Immigration Judges v. FLRA with a per curiam opinion applying the incurably premature doctrine. In his concurrence, Judge Randolph summarizes that doctrine as follows:

Here, the Executive Office for Immigration Review asked the FLRA to determine that immigration judges—who have long collectively bargained through a certified union—are management officials who may not take part in a bargaining unit. The FLRA agreed. The union sought reconsideration. (The Executive Office backed the union’s request, its position having changed with the administration.) After the FLRA denied the first reconsideration motion, the union did two things: it filed a second motion for reconsideration, and it petitioned the D.C. Circuit to review the original decision and denial of its first motion. The FLRA then denied the second reconsideration motion. The Court held that the union is now out of luck: the second reconsideration motion rendered its petition for review premature for want of a final agency action, and the petition did not ripen when FLRA denied the second reconsideration motion. Now, it appears that the union has missed its chance to petition for review of the denial of its second motion. As Judge Randolph points out in his concurrence, the Federal Rules of Appellate Procedure once had a rule that rendered premature appeals incurable. The rule was amended to eliminate what many reviled as a “trap for the unwary.” Judge Randolph recommends a similar revision to the D.C. Circuit’s incurably premature doctrine.

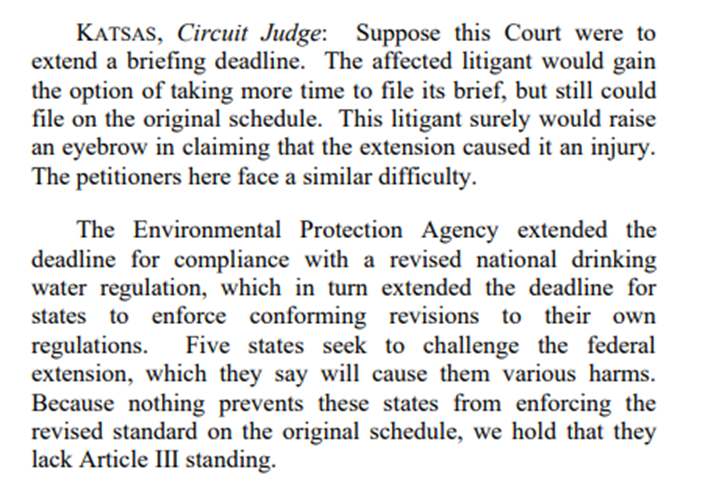

The Court also dismissed the petition for review in Arizona v. EPA—this one, for lack of standing. Several states brought this petition to challenge EPA’s delay in the compliance deadline for a national drinking water regulation. Judge Katsas (joined by Judges Randolph and Rogers) succinctly captures the standing analysis with an analogy:

In Optimal Wireless v. IRS, the D.C. Circuit considers the age old question whether a payment required by the Affordable Care Act is a tax or a penalty. In this case, IRS assessed exactions against Optimal Wireless for not providing adequate coverage to some employees. Optimal sued to enjoin the assessment or collection of the exactions on procedural grounds. If the exactions are taxes, then the requested relief would run afoul of the Anti-Injunction Act., which strips federal courts of jurisdiction to restrain the assessment or collection of taxes. The circuits have split on whether these exactions are taxes. The D.C. Circuit sides with the Fifth Circuit in holding that they are. The opinion (Chief Judge Srinivasan, joined by Judges Williams and Tatel) includes an interesting review of the difference between the constitutional and statutory concepts of a “tax.”

The Court also issued several decisions in cases that do not directly implicate administrative law.

The headline grabber for the week is the opinion in In re: Sealed Case, which revealed that Special Counsel Jack Smith subpoenaed Twitter’s records related to Donald Trump’s Twitter account. Smith obtained an order barring Twitter from disclosing the subpoena to Trump, which Twitter challenged under the First Amendment. The district court refused to stay enforcement of the search warrant while it adjudicated Twitter’s challenge, which it later rejected. The district court also imposed a $350,000 sanction on Twitter for its delay in responding to the subpoena. The Court (Pan, joined by Pillard and Childs) affirmed the district court in all respects. Portions of the opinion describing the Government’s ex parte presentation to the court remain redacted.

Next, Ramos v. Garland, which Garrett West covered in Twitter-worthy detail a few weeks ago:

The Court has now unsealed the opinion (Judge Wilkins, joined by Chief Judge Srinivasan and Judge Pan), which affirmed in part and reversed in part the district court’s grant of summary judgment in favor of the FBI on Agent Laura Ramos’s Title VII retaliation claim. The panel found that Ramos raised a genuine dispute as to whether her supervisor took a “materially adverse action” with retaliatory motive when he withdrew an offer to transfer Ramos.

Finally, Simon v. Hungary will carry into its fourteenth year an effort by survivors of the Holocaust to obtain compensation from the government of Hungary for expropriated property. The case has already been twice before the D.C. Circuit and once before the Supreme Court—all on motions to dismiss. Two years ago, the Supreme Court held in Germany v. Philipp that citizens of a foreign sovereign may not invoke FSIA’s expropriation exception to sovereign immunity to sue their own government for expropriating property. This is the “domestic takings exception.” It then remanded Simon for reconsideration in light of Philipp. On remand, certain plaintiffs argued that, although Hungary had annexed the territory on which they lived at the start of WWII, they were not in fact citizens of Hungary and thus do not fall within the “domestic takings exception.” Judges Pillard and Childs have now allowed some of their claims to move forward. Judge Randolph dissented in relevant part, on the ground that the plaintiffs had failed to preserve this theory of jurisdiction.

D.C. Circuit Review – Reviewed is designed to help you keep track of the nation’s “second most important court” in just five minutes a week.

* Judge Silberman was the third member of the panel but passed away a few days after argument.