D.C. Circuit Review – Reviewed: This Week’s *Other* Nondelegation Case

Justice Kavanaugh got folks chatting this week about nondelegation. In particular, although the Supreme Court denied rehearing in Gundy v. United States, Kavanaugh issued a short statement suggesting that he may be open to joining Justice Gorsuch’s effort to reinvigorate the nondelegation doctrine.*

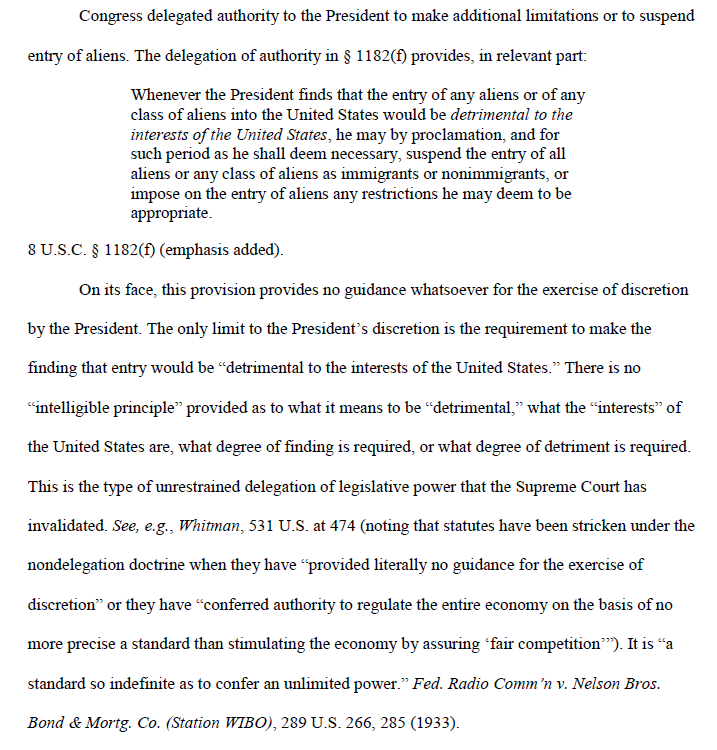

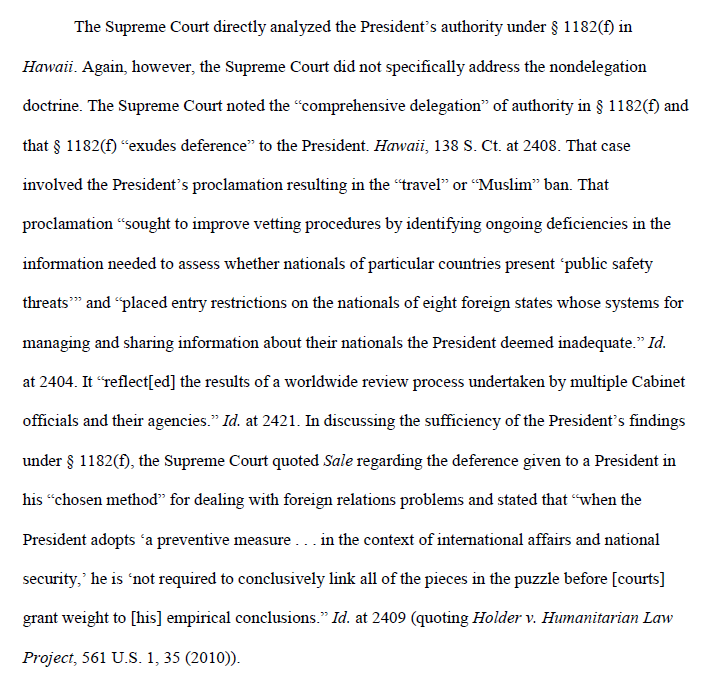

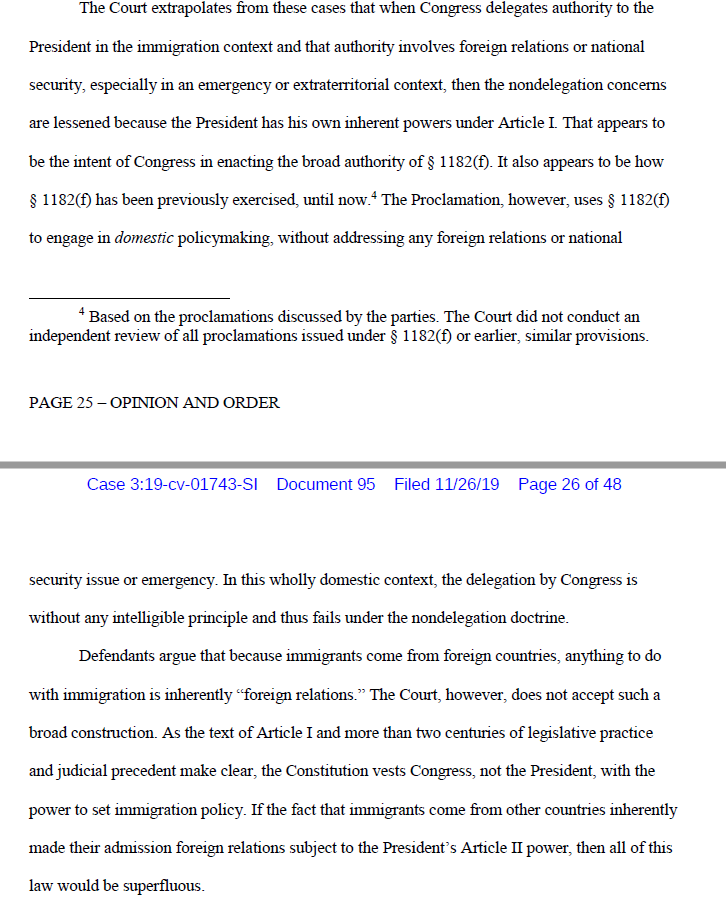

Given the holiday, however, you may have missed this week’s other nondelegation case. In Doe #1 v. Trump, the District of Oregon concluded that the “Presidential Proclamation on the Suspension of Entry of Immigrants Who Will Financially Burden the United States Healthcare System” violates the nondelegation doctrine. Here are the key parts of the district court’s analysis:

The court went on to say that the Proclamation isn’t authorized by statutory law either.

In light of the district court’s grant of a preliminary injunction, it seems pretty safe to say that the nondelegation issue will soon be briefed to the Ninth Circuit. For what it is worth, although I confess that I haven’t spent a great deal of time with this issue, I am surprised that the district court did not discuss Schechter Poultry and that it relegated Panana Refining Co. v. Ryan to a footnote. Nor did the district court dive especially deep into more recent nondelegation cases that have taken a pretty forgiving approach to “intelligible principles.” I also wonder whether the Department of Justice will agree that the Proclamation’s lacks a meaningful nexus to foreign affairs. Presumably these issues will be fleshed out on appeal. Even so, the decision is worth flagging.

***

The D.C. Circuit decided two cases this week. In Porzecanski v. Azar, Judge Henderson, joined by Judges Katsas and Sentelle, concluded that “after properly channeling a single claim for ‘medical and other health services’ benefits, a Medicare beneficiary can[not] obtain prospective equitable relief mandating that HHS recognize his treatment as a covered Medicare benefit in all future claim determinations.” After all, “Porzecanski cannot satisfy § 405(g)’s presentment requirement with respect to future claims because those claims have not yet arisen. … Here, the Secretary has not decided Porzecanski’s future claims because — to state the obvious — none has been submitted.”

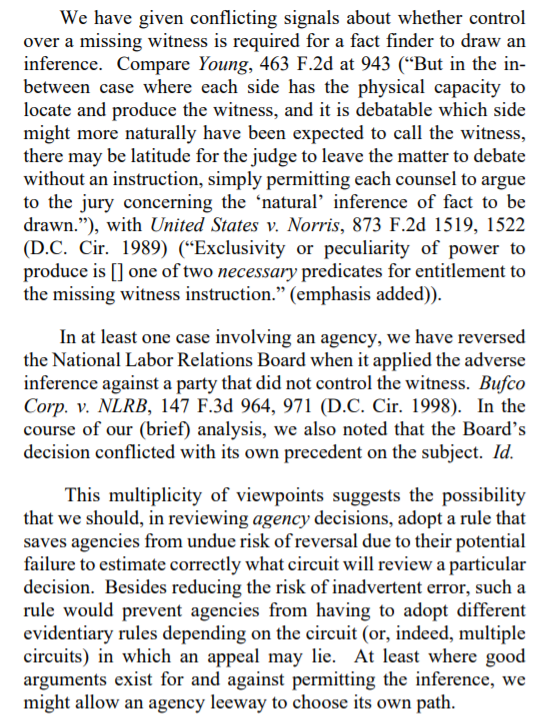

In Endeavor Partners Fund, LLC v. IRS, Judge Williams, joined by Judges Henderson and Griffith, addressed a particular type of tax shelter. If you’re a tax lawyer, give it a read. I want to focus on something else, however:

If you’re curious where Judge Williams went with that provocative thought, read the opinion!

* Cf. this post.

D.C. Circuit Review – Reviewed is designed to help you keep track of the nation’s “second most important court” in just five minutes a week.